Within today's fast-paced trading landscape, traders are constantly seeking an advantage to stay ahead of their rivals. The introduction of sophisticated trading tools has transformed how both novice and experienced traders handle their strategies. By utilizing the capabilities of tech, traders can streamline their operations, make informed decisions, and ultimately boost their profits. This transition toward automated trading platforms is not just a fad, but a vital adaptation to an ever-evolving market landscape.

Using trading software offers many benefits that can transform your trading experience. From immediate information evaluation to improved risk management, these tools allow traders to react swiftly to market fluctuations. They provide insights that would be hard to glean through conventional methods, enabling for more calculated decision-making. Adopting these technological advances creates new possibilities for expansion, ensuring traders can effectively navigate the complexities of the trading markets.

Grasping Trading Systems

A trading system is a particular methodology or algorithm used by market participants to make buy or dispose of decisions in financial markets. These systems can range from simple rules-based strategies to sophisticated algorithmic programs that assess vast amounts of data. Market participants utilize trading systems to create a structured approach that helps them deal with the market’s volatility and make knowledgeable decisions. By defining clear entry and exit points, a trading system can reduce emotive decision-making and help maintain control.

One notable benefit of trading systems is their capability to backtest trading strategies against historical data. This process allows market participants to evaluate how a strategy would have performed in various market conditions without risking actual capital. Backtesting can show the strengths and weaknesses of a trading approach, leading to improvements and refinements before live application. By utilizing software tools, traders can streamline this process, saving time while enhancing their trading strategy's precision.

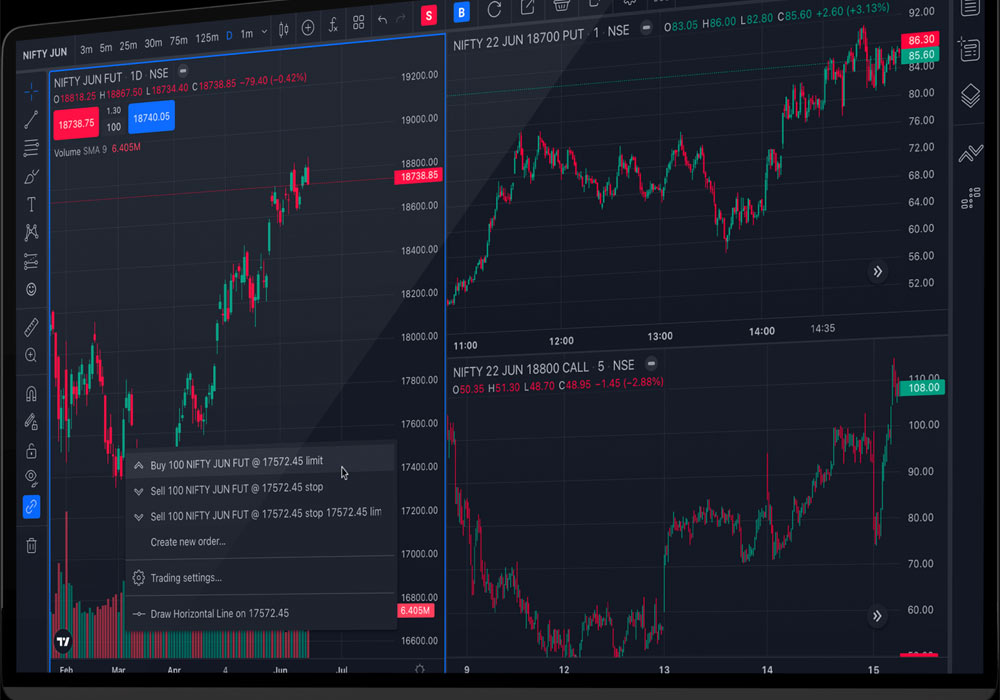

Furthermore, modern market trading systems can integrate various technical indicators and financial data feeds, providing extensive insights in real-time. With the progress of technology, investors can access cutting-edge software that offers features such as real-time data analysis, risk management management tools, and customizable alerts. These features empower investors to react swiftly to financial changes and capitalize on emerging opportunities, ultimately increasing their potential for gains.

Advantages of Trading Software

Trade software offers a variety of benefits that can considerably boost a trader's capacity to execute profitable strategies. One of the primary advantages is the automated process of transactions, which reduces the emotional component of trading. By using automated trading systems, traders can set preset rules and criteria, allowing the application to make trades on their account. This guarantees that choices are based on information and established guidelines, rather than being influenced by fear or greed.

Another notable advantage is the availability to real-time financial data and analysis. Trade software provides users with up-to-date information, allowing them to examine patterns and financial movements effectively. With advanced graphical tools and signals, traders can gain deeper understanding into financial conditions, helping them to spot possible chances and threats. https://www.tradesoft.es/ of scrutiny can be difficult to achieve by hand, rendering applications tools invaluable for knowledge-based decision-making.

Lastly, trade applications enhances productivity and speed, which are crucial in the fast-paced trading environment. With the ability to perform trades within milliseconds, traders can take advantage of fleeting opportunities that may occur. Additionally, many trading systems offer capabilities such as backtesting, which allows traders to test their strategies against historical data before applying them in the live market. This feature helps in improving strategies and boosting overall trade performance.

Carrying Out Your Strategy

After you have established a trading system that aligns with your goals, the subsequent step is to implement your strategy efficiently. Employing investment software permits you to streamline your trading activities, lowering the emotional strain that often is associated with hands-on trading. This mechanization allows for steady implementation based on set criteria, which can greatly enhance your profits. The application can also monitor financial conditions in immediate time, ensuring that you can take advantage of opportunities as they present themselves.

Additionally, trading software provides advanced analytics and reporting tools that help you comprehend the success of your strategy. Through detailed charts, risk analyses, and historical result analysis, you can recognize trends and patterns and make educated decisions about adjustments needed for your trading system. This analytical skill is crucial in refining your approach and ensuring that you are always advancing towards better results.

Ultimately, the use of trading applications fosters adaptability in a swiftly changing market environment. As economic dynamics evolve, your application can quickly include new data, allowing you to alter your financial strategy on the spot. This flexibility can be the key to holding an edge over other traders. By capitalizing on the capabilities of tech innovation in your trading system, you can enhance your approach and eventually boost your gains.